Tackling the Lobito (debt) Corridor; Critical is whatever gets investors excited; US and EU still can’t agree; Bets on ethical cobalt are made; EU ditches preaching for a deal with the Uzbeks...

Happy geologist day to all the rock lickers out there! The undisputed heroes of the industry. No fake news have been detected in this statement.

Source: A Rare Geology Cartoon - Jim Letourneau’s Blog.

This week on the menu:

The US lacks a coherent international critical minerals strategy and it shows | Confronting the China Challenge in Africa: The Lobito Corridor

C’mon guys, critical minerals have a meaning….| Nine Critical Energy Minerals for Investors

Competitors make for poor friends | US, EU set to miss critical minerals agreement this week

The friends of our adversaries are our friends | EU establishes strategic partnership with Uzbekistan on critical raw materials

Everyone has ethics until it’s time to make a profit | Australian cobalt refiner bets on demand for 'ethical' China-free EV metals

NGOs' favourite is at it again | As Rio Tinto strives for ‘impeccable ESG’, investors raise water issues

Barking up the wrong tree | Mining magnate Andrew Forrest urges China to demand greener nickel, FT reports

Get involved

Commentary, responses, and questions are most welcome. If you think I’ve lost my marbles, let’s talk about it. Challenge, question, and debate with reason not emotions.

Disclaimer. Do your own research. Not for the woke.

Please don’t sue me.

The US lacks a coherent international critical minerals strategy and it shows

Confronting the China Challenge in Africa: The Lobito Corridor

The Lobito Corridor runs from Zambia, the Democratic Republic of the Congo, to the Angolese port of Lobito. It’s a gigantic undertaking to counter China. Some 800 kilometers of a new track must be built in Africa. An initial $1.6 billion will fund 1,500 wagons, 35 locomotives, and the upgrading of existing rail lines and port terminals. The US has already committed an additional $2.3 billion for the railroad and accompanying mining and refinery projects, most in loans from the Development Finance Corporation and the Export-Import Bank.

The potential prize is enormous: the Congo and Zambia are the top African producers of copper, accounting in 2022 for 2.3 million and 797,000 tons respectively. Copper is crucial to building electric batteries, wind turbines, and electric car charging ports. Angola is also resource-rich, possessing reserves in 32 of the 51 minerals vital to green technology.

Yes, however, who owns and controls existing projects (hint, they’re going after the US at the WTO), plus the terms of existing offtake agreements are paramount.

The Lobito project is shaping up as a giant test of Western will to counter China. In order to succeed, the West now must mobilize the private sector and resist its own protectionist urges. But Lobito comes at a propitious time. China’s African investments are falling, and both the US and EU are pledging financial support for the project.

The US is not making this investment out of the kindness of their heart but to reap benefits in the form of access to minerals and a foothold in China’s paradise. Protectionism is necessary for survival, something that the West has forgotten about and is now paying the price.

But timing is everything for the private sector, and President Hichilema’s plans to introduce legislation aimed at prohibiting the sale of mining licenses to foreigners do not bode well for those looking to enter the market without backroom deals. According to transparency.org, DRC ranks 166/180 in the corruption perception index, while Zambia ranks at 116/180…

As for China, it’s facing problems at home but also expanding its portfolio aggressively across Latin America. The West is simply treading a decade behind.

But obstacles remain. Zambia’s unsustainable national debt has led to missed payments and debt restructuring. Civil War in the eastern Congo threatens to interrupt the construction of the railway’s Congolese section.

High risk, high reward. Albeit Zambia being at the mercy of the Chinese will pose more headaches for the US. The Paris Club (creditor nations with eligible claims on Zambia include Belgium, Denmark, France, Israel, Italy, Japan, the Netherlands, Russia, South Africa, Sweden, Switzerland, the UK and the USA) agreed to restructure Zambia’s $6.3 billion worth of loans. The clincher is that over $4 billion is owed to the Export-Import Bank of China. After significant delays, Zambia announced it had reached an agreement with a group of private creditors on restructuring $3 billion of its international bonds last month.

The lack of a transatlantic agreement on critical minerals represents another hurdle. Without common US and EU standards on minerals, imports could be subject to tariffs and delays. So far, the allies have not offered African minerals free market entry. A potential solution would be to declare the Lobito Corridor and Port a Special Economic Zone that would allow suppliers full access to the EU and US markets.

A SEZ could do a wealth of good for Zambia and Angola. Yet, there are a few problems here straight off the bat. Setting common standards that meet Western expectations and placate anti-mining sentiment with sufficient virtue-signalling carbon expectations would most likely render many African minerals illegible, or at least see them tariffed out of the market (unless entering via backdoors like Mexico).

The problems of African minerals would seep into EU and American markets in plain view, i.e. neither governments nor OEMs could pretend they do not know about the environmental and social cost of those minerals. Only giving the woke left further ammunition to lobby Washington and Brussels against the industry as a whole. Although we’re all collectively blind for the right price. Plus, any minerals that adhered to any standards would end up mixed up with those extracted by the Chinese and via artisanal mining without strict controls.

Free market entry from less regulated jurisdictions, particularly those gripped by overwhelming Chinese presence also stands to undermine US domestic production (since we know that the EU, outside of few bastions of hope of member States has fallen to BANANAISM – Build Absolutely Nothing Anywhere Near Anything - and is going to struggle to hit its 10% mining target). The U.S., despite its poor approach to untangling permitting, is in dire need of building state-of-the art mines back at home to meet its defence needs which inevitably will cost a whole lot more dollars than African counterparts.

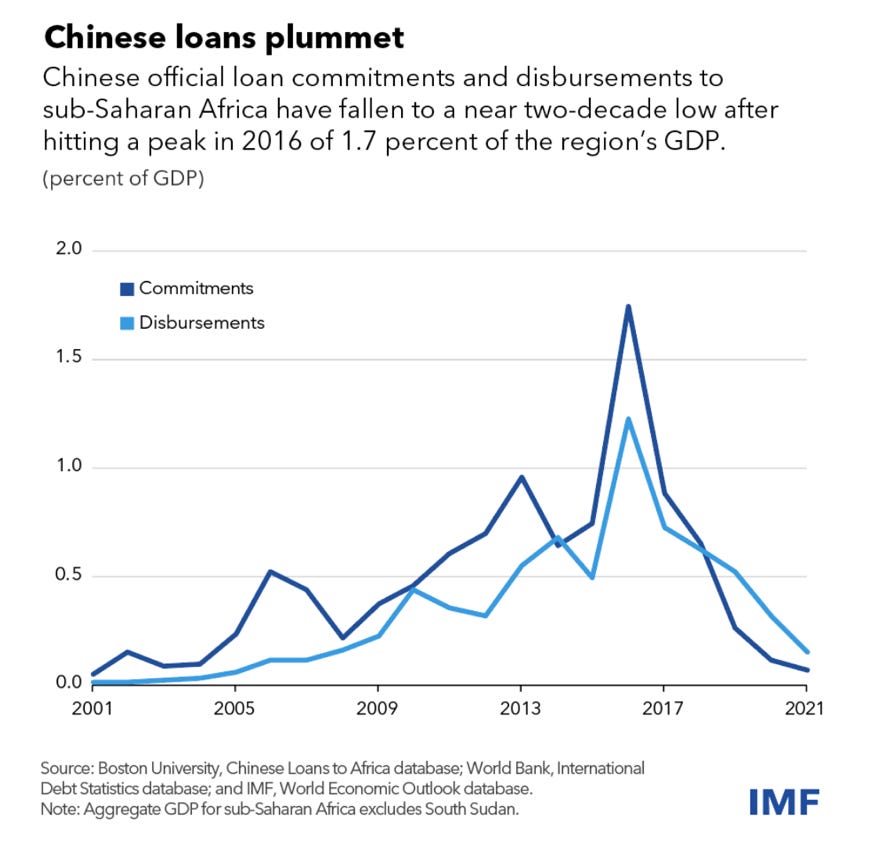

Over the past decades, Beijing has built roads, ports, and other infrastructure throughout Africa, gaining a stranglehold on the continent’s rich mineral resources. Chinese loans often contain punitive terms and entail risks of a debt trap. Sri Lanka defaulted on its loans taken out for China to build the Hambantota Port. More than half of China’s $1.1 trillion of loans to low and middle-income countries have entered their principal repayment periods, prompting Beijing to reduce exposure to distressed debt. China’s foreign direct investment in Sub-Saharan Africa fell by 55% in 2022 from 2021.

China’s loan showers across the continent have declined significantly. While the control of key infrastructure has its merits, the lack of monetary repayments have their drawbacks too. However, this has not seen Chinese “private” (used loosely) companies exiting or shying away from acquiring assets in mineral-rich provinces.

The US now has to contend with Gulf nations too who are coming in hot with lavish courtship of African leaders and the wads of cash that could make debt-ridden nations partial to choosing a new master. As a Zambian official put it for the Financial Times, “Getting investment from the Middle East gives relief from being seen to be in favour of one region or the other”.

As the West squabbles over how to build responsible supply chains or create a parallel market with ESG price premiums…the alternative midstream will be built in the Gulf, sucking up minerals without the terrible affliction that the West suffers from – guilt.

C’mon guys, ‘critical minerals’ have a meaning…

Nine Critical Energy Minerals for Investors

Sprott has identified the following minerals from the U.S. 2022 Critical Minerals List as fundamental to the energy transition, offering significant financial opportunities for investors as the transition accelerates.

Someone at Sprott either didn’t do their research or are turning ‘critical minerals’ into the new ‘ESG’ - it means whatever sounds good to the marketing team.

Honestly, we’re just missing coal, gold and iron ore from fighting for the prestigious title of ‘critical’.

On a serious note, as pretty as the latest infographic is from the Visual Capitalist it is somewhat misleading.

Critical minerals have a definition. It’s not simply a marketing term.

What is a critical mineral?

From Geoscience Australia, “A critical mineral is a metallic or non-metallic element that has two characteristics: It is essential for the functioning of our modern technologies, economies or national security. There is a risk that its supply chains could be disrupted.”

The U.S. Energy Act of 2020 defines a “critical mineral” as a non-fuel mineral or mineral material essential to the economic or national security of the U.S. and which has a supply chain vulnerable to disruption. Critical minerals are also characterized as serving an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.

Criticality

Criticality (or how important a mineral is to a nation) is determined by the relationship between supply risk and vulnerability (e.g. economic and security), both which are influenced by geopolitics. As it is often said, without China’s aggressive monopoly there would be no critical minerals. They would just be called minerals.

Rare earths are a good example of being highly critical. Without a supply of rare earths, the US military capability is kaput pretty quickly, and automakers like GM wallow in their board rooms about selling Magnequench to the Chinese decades prior. The chances of disturbances are high given that China controls around 85% of global REE processing and likes to slap around export restrictions.

Conversely, minerals like cobalt and lithium are critical due to their use in batteries and the underlying promise of helping to deliver decarbonization – a strategy path for growth chosen by the West. Both lithium and cobalt are dominated by China (in the midstream space which holds the key to the supply chain), however, should technologies evolve rapidly, hydrogen kicks in a lot sooner than anticipated, or Trump decides to take another growth pathway, both metals can fall down the pecking order quite quickly.

What affects criticality?

Geopolitical disturbances to supply chains.

Projected demand for energy transition applications, defence, technology and agriculture outstripping current and projected production;.

Limitations of the circular economy, including recovery rates, policy and legislation, technological challenges.

Increased nationalisation of resources.

Lack of substitution options.

Blurred lines

Uranium has sneaked its way onto Canada’s and Japan’s critical minerals lists and is one of the investors’ favourites however, uranium as a fuel is not a critical mineral by the US definition. National critical minerals lists are increasingly becoming critical resources and materials lists (e.g. the US Defence Logistics Agency’s Strategic Materials list features a variety of materials and minerals).

Another anomaly is gold on Japan’s 2018 critical minerals list. Although I fear even writing this will spike “gold is a critical mineral” at conferences. Lord save us.

Silver, despite the incessant chorus of investors pushing it as an energy critical mineral, is safe for now with relatively diversified production across Mexico, China, Peru, Chile, Poland and others.

For the time being, in my humble opinion, gold, silver, coal or iron ore (if I had a dollar for every time an Aussie tried to peddle this…) meet neither of the two criteria to be classed as critical in the Western world. Sure, they’re all important in their own rights, but not critical.

While there is no set list of “critical minerals” in the same way that base metals are base metals no matter whether you’re in Afghanistan or Greenland, national lists reflect critical minerals (and increasingly resources and metals) that are necessary for economic and national security. This is where the lines become blurred as policymakers tag on other resources “critical” to achieving strategies and policy goals.

An all encompassing global critical minerals list would not be fit for purpose.

If everything is critical, then nothing is critical. Criticality is not an exercise in equality but in addressing strategic gaps.

Competitors make for poor friends

US, EU set to miss critical minerals agreement this week

A US and European Union push to reach an accord on fostering critical mineral supply chains is set to miss another target this week, according to people familiar with the discussions.

The final draft statement for a high-level trade and technology meeting in Leuven, Belgium, on Thursday falls short of a deal, instead, it says the transatlantic allies “are advancing negotiations toward a critical minerals agreement,” according to a document seen by Bloomberg. An earlier version of the statement left open the door to an “agreement in principle.”

Sounds like a piece of paper with little weight behind it will be published soon. Although the US and the EU find themselves in a similar boat, both racing to untangle themselves from the mess created by careless offshoring, the two are effectively competing with each other on the international stage to make friends and secure their respective critical minerals needs.

If you want to go fast, you go alone. If you want to go far, you go together. If you want to go anywhere at all in the next decade, you choose a more agile partners than the EU.

A minerals accord would act as the equivalent of a free-trade agreement and that status would in turn enable electric vehicles containing EU-extracted and processed critical minerals to be eligible for IRA subsidies.

However, the benefits of having an FTA-like status through a minerals deal would likely not stretch to recycled critical minerals nor would it blunt final assembly provisions, meaning that many of what the EU sees as unfair irritants in the IRA would remain.

Subsidies run the world it would seem. But the core of the matter here is the midstream processing and refining (since the EU extracts a meagre amount of critical minerals). The EU’s push would see fewer companies opting to set up processing and refining facilities in the US instead of the EU. This would be great for the EU and makes life easier for European-US OEMs, but delivers little benefit to the US who could stick to having the whole pie or share it with its ailing friend over the Atlantic.

If an agreement is not reached before the election, it may well fall through entirely if Trump comes into office.

The friends of our adversaries are our friends - an EU proverb

EU establishes strategic partnership with Uzbekistan on critical raw materials

The EU and Uzbekistan signed a Memorandum of Understanding (MoU) launching a strategic partnership on critical raw materials (CRMs). This important agreement marks a significant step towards securing a diversified and sustainable supply of CRMs for the green and digital transitions both in the EU and Uzbekistan.

This strategic partnership focuses on the following areas of cooperation:

i. Integration of sustainable CRM value chains, including via networking, selection of project proposals, joint development of projects, promotion and facilitation of trade, and investment linkages along the whole value chain;

ii. Increasing the resilience of CRM supply chains and establishing a dialogue to enhance the transparency of measures related to investments, operations and exports;

iii. Mobilisation of funding for projects resulting from the Partnership, as well as for the development of infrastructure required for the development of CRM value chains such as, but not limited to, the development of clean energy supply;

iv. Cooperation to achieve sustainable and responsible production and sourcing of CRMs;

v. Cooperation on research and innovation, including the sharing of knowledge and technologies related to sustainable exploration, extraction, processing and recycling of CRMs;

vi. Cooperation on building of capacity to enforce relevant rules, and on developing training and skills.

The MoU signing season is back! Now taking bets that the UK and US will announce their own MoUs within the month. Central Asia and long-forgotten African nations are going to be riding the wave of finally getting some precious face-to-face time with the inaccessible West.

However, how the EU selects its partners boggles the mind. Following China’s greatest debtors seems to be a pattern. It seems that all the virtue signalling and lectures on ethics and authoritarianism quickly go out of the window if critical minerals are involved. Coming next week, the EU signs an MOU with Iran.

Logistically, getting any future critical minerals out of the country into the EU will be challenging given the local neighbourhood. While Kazakhstan seems to be searching for greater alignment with the West, it too faces a similar problem.

China’s debt grip on Uzbekistan will not be an easy one to tighten for the EU if the partnership is to bear any fruit.

Uzbekistan is unlikely to diversify too much in actual terms should it anger its overlord whose ambitious plan hopes to connect China with Europe via Central Asia by rail (bypassing Russia). After all, Xi himself visited Uzbekistan earlier this year so it’s not outrageous to assume that Uzbekistan is a significant piece in Jinping’s puzzle.

I expect the West will pump money into Central Asian nations over the next decade, but the minerals will ultimately end up in China or Russia. The miners will make money, and the politicians whose policy fails will be long gone working as consultants.

The wheelers and dealers who know how to work their way around kleptocracies have everything to gain, and now with the EU’s blessing. Tom Burgis will not be running out of material anytime soon.

Everyone has ethics until it’s time to make a profit

Australian cobalt refiner bets on demand for 'ethical' China-free EV metals

Cobalt Blue aims to produce "ethical" battery-grade cobalt sulfate in Western Australia in partnership with Japanese oil and gas refiner Iwatani Corp. at a site the latter owns near Perth in Western Australia.

What is ‘ethical’ cobalt? One person’s ethics is another’s lack of them.

"I don't think that most of the people in the market realize that on Jan. 1, 2025, the [foreign entity of concern] rules are in full effect," said Joel Crane, head of investor relations for the firm.

"By next year, if any part of the battery [is linked to] an FEOC, it is not eligible, so there will be very few models of EVs in the U.S. that will be eligible, so those that are will have such an outstanding sales advantage," he said.

The lobbyists descending on Washington D.C. in the run-up to the finalization suggest the downstream market is very well aware and attempting to maximize access to the subsidies (which many OEMs will fail to qualify for due to supply chains entangled in China or Chinese-owned entities).

Rules vs implementation are not the same.

Malan said while the intent of the IRA was "clear" he was concerned the guidance was "too loose" and left open workarounds for companies from FEOC covered countries like China to still benefit from the scheme via corporate restructuring.

Chinese OEMs are determined to benefit from IRA subsidies and to dominate the US market. Backdoors via Mexico and FTA nations and restructuring are already taking place.

For an opinion take on FEOC, check out a friend’s piece here.

Chinese investment in Australia's critical mineral sector, and its reliance on China for processing raw ore, would pose at least a short term barrier for some players in the industry to comply with the IRA, said Jackson Ewing, director of energy and climate policy at Duke University's Nicholas Institute for Energy, Environment and Sustainability.

Western Australia runs on Chinese money. Dig and ship baby.

But long term it could create a new boom, he said, particularly if the IRA is amended so tax credits are made available to miners.

If this idea ever takes root, it will be for US miners only who have a direct route to market, i.e. a U.S. customer. Anything other would be a global handout with every Tom, Dick, and Harry trying to sell shit grade lithium to the U.S. for some subsidy action.

Cobalt Blue's refinery is expected to cost about 100 million Australian dollars ($65 million). The company is putting a funding package together that will likely include financing from the Australian government, which wants to boost its midstream and downstream industries to capture more value from clean energy technologies.

Cobalt Blue's plans for a mine in New South Wales to feed its refinery have been shelved amid the downturn, with the company planning to buy feedstock to process. Crane said the company was in discussions with a number of battery manufacturers and automakers about offtake agreements.

If a mine had to be put on hold, the “ethical” cobalt may be too when the realities of sourcing it hit and contend with profit margins. Doing “the right thing”, whatever that may look like, is no easy task in monopolised markets.

NGOs' favourite is at it again

As Rio Tinto strives for ‘impeccable ESG’, investors raise water issues

Rio Tinto faced demands from shareholders at its annual meeting on Thursday to come clean on environmental issues, including water and biodiversity, as the company said it was committed to achieving an “impeccable ESG” performance. […]

Rio aims to reduce Scope 1 and 2 carbon emissions – direct emissions by the company and certain types of indirect emissions – by 15% by 2025 and 50% by the end of the decade.

Given some of the other headlines over the past week, Rio’s focus should be less on worshipping at the carbon shrine and more on the mitigation of waste and toxic leakages. But the shareholders want what the shareholders want.

The Anglo-Australian miner is developing part of the Simandou project in Guinea, one of the world’s largest untapped iron ore deposits, where more than 23,000 chimpanzees could be impacted by mining activities, the study said.

I doubt Rio’s Chinese state-owned partners will care much about the possibility of impacting 23,000 chimpanzees, as long as the ore makes its way to China. Getting in bed with competition never ends well, especially a subsidiary of a state owned enterprise. Any missteps will of course be borne by Rio, as the NGOs have an unwritten pact to leave Chinese companies out of it.

Rio’s been making some other headlines recently including:

Rio Tinto plots ‘nature targets’ to curb impact of huge mine in Africa

A shift from no “net negative” to “net positive” approach but it all comes down to delivery.

Villagers near Madagascar mine take legal action against Rio Tinto

QIT Madagascar Minerals produces ilmenite, a source of titanium dioxide. A critical mineral, unlike iron ore. And for those living in the UK, the delicious Morrisons custard doughnuts have quite the ingredient list including titanium dioxide.

Norway sovereign fund advisor may recommend Rio Tinto stake sale

The ethics adviser is assessing whether the fund should divest. If a fund needs an ethics advisor, questions should be raised. This time, the concern is on deforestation of the Amazon by an operation not directly managed by Rio.

Rio is a giant and clunky beast. It has a long way to go before it can operate in the agile way necessary to translate board-level ESG mantra down the multistorey ranks all the way to project level – which is ultimately where ideals meet reality. Rio is not the only company suffering from its size, but it’s certainly on the top of NGOs and reporters’ radar and any mistakes quickly become global news.

Meanwhile, the UK is quite literally drowning in shit and ‘just stop sewage’ activists are nowhere to be seen.

Barking up the wrong tree

Mining magnate Andrew Forrest urges China to demand greener nickel, FT reports

Australian mining magnate Andrew Forrest has called on China to demand higher environmental standards from its global supply chain, particularly its companies conducting nickel processing in Indonesia, the Financial Times said on Sunday.

Forrest, the chairman of Fortescue Metals Group, said in an interview with the FT that electric vehicle manufacturers should be wary of Indonesian nickel, adding that it was being extracted at immense cost to the environment.

“China will need to enforce its own environmental standards on its global supply chains,” Forrest is quoted as saying by the newspaper during a visit to Boao, China. He further added that every buyer of nickel “needs to be really careful if they’re buying from that (Indonesian) source.”

Firstly, hats off for having the balls to call on China to do anything.

Indonesia is China’s golden goose, and turning its operations more responsible will slash those golden profits. However, if the market demands it, China may well begin cleaning up its act. That is if the middle classes demand to buy ESG-rated products. For the time being, the demand is to clean up China itself, before cleaning up the rest of the world. Until then, it’s business as usual.

Geopolitically speaking, China cleaning up its supply chains would be a disaster for the West which would no longer have ESG as the cover for the attempts to create a parallel supply chain. Nor would the Western market have a USP to contend with more favourable Chinese prices. If the CCP issues subsidies for cleaner Chinese minerals and metals, the West will be left with no advantage, and it will become almost impossible to persuade the unpatriotic manufacturing industry to pour money into detangling from China.

It’s all fun and games.

That’s it folks. Thanks for reading!